Hey there, folks! If you've ever wondered about the red hot net worth of celebrities, entrepreneurs, or even yourself, you've landed on the right page. In today's world, money talks, but understanding wealth is more than just numbers on a screen. It’s about knowing how to manage, grow, and protect your assets. So, buckle up because we’re diving deep into the fiery world of wealth. And trust me, it’s gonna be a wild ride.

Let’s face it, the term "net worth" gets thrown around a lot, but what does it really mean? Why is it so important? Think of your net worth as a snapshot of your financial health. It’s the difference between what you own (assets) and what you owe (liabilities). For some, it’s a badge of honor, while for others, it’s a wake-up call. But no matter where you stand, understanding your red hot net worth is key to building a prosperous future.

Now, before we jump into the nitty-gritty, let me tell you why this topic matters. Whether you're trying to climb the corporate ladder, start your own business, or just live a more financially stable life, knowing your net worth is essential. It’s not just about being rich; it’s about being smart with your money. So, let’s light the fire under our wallets and get started!

- Cee Dee Injury A Comprehensive Guide To Understanding And Overcoming Cdh Challenges

- Ingram Show The Ultimate Guide To Understanding Its Impact And Reach

What Exactly Is Net Worth Anyway?

Alright, let’s break it down. Your net worth is basically the total value of everything you own minus all your debts. It’s like taking a financial selfie, but instead of filters, you use math. For example, if you own a house worth $500,000 and have a mortgage of $200,000, your net worth from that asset alone would be $300,000. Simple, right?

But here’s the kicker: your net worth isn’t just about big-ticket items like homes or cars. It includes everything from your savings account to your retirement funds, investments, and even that vintage guitar collecting dust in your attic. On the flip side, it also accounts for all your debts, like student loans, credit card balances, and car payments. So, when people talk about red hot net worth, they’re usually referring to someone whose assets far outweigh their liabilities.

Now, why does this matter? Well, your net worth is a powerful indicator of your financial health. It helps you understand where you stand financially and what steps you need to take to reach your goals. Whether you’re aiming for financial independence or just trying to pay off debt, knowing your net worth is the first step.

- Bk Nets Trade Rumors The Buzz The Hype And Whats Really Happening

- Cg Commandant Fired The Inside Story You Need To Know

Why Is Red Hot Net Worth Important?

Let’s talk about the "red hot" part. When someone’s net worth is described as red hot, it usually means they’ve hit the jackpot in terms of wealth. These are the folks who’ve built empires, invested wisely, and made smart financial decisions. But what makes their net worth so fiery?

- They’ve maximized their assets: These individuals have diversified their investments, owned valuable properties, and built successful businesses.

- They’ve minimized their liabilities: They’ve paid off debt, avoided unnecessary expenses, and lived within their means.

- They’ve prioritized growth: Instead of spending recklessly, they’ve reinvested their profits and sought out opportunities to expand their wealth.

So, if you’re aiming for that red hot status, you’ll need to adopt some of these strategies. It’s not about being flashy; it’s about being smart. And trust me, the results can be life-changing.

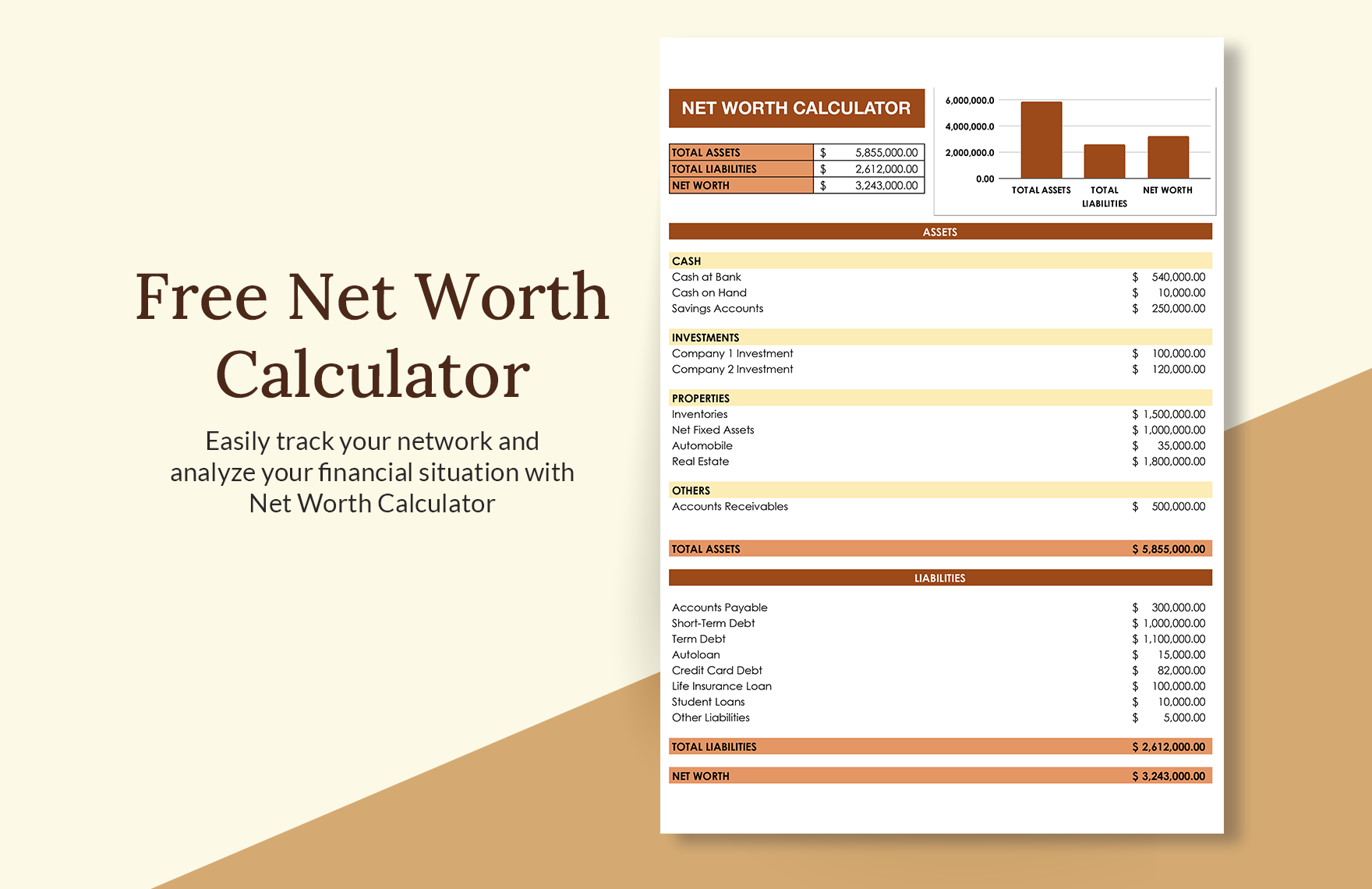

How to Calculate Your Net Worth

Calculating your net worth might sound intimidating, but it’s actually pretty straightforward. All you need to do is add up all your assets and subtract all your liabilities. Here’s a quick breakdown:

Step 1: Tally Up Your Assets

Assets are anything you own that has monetary value. This includes:

- Cash and savings accounts

- Investments (stocks, bonds, mutual funds, etc.)

- Real estate (homes, rental properties, etc.)

- Vehicles (cars, boats, motorcycles, etc.)

- Retirement accounts (401(k), IRA, etc.)

- Personal belongings (jewelry, art, collectibles, etc.)

Take a moment to list out everything you own and assign a value to each item. Don’t forget to include any side hustles or businesses you might have. Every little bit counts!

Step 2: List Your Liabilities

Liabilities, on the other hand, are all the debts you owe. This includes:

- Mortgage payments

- Car loans

- Student loans

- Credit card balances

- Personal loans

Again, make a list of all your debts and add them up. This will give you a clear picture of how much you owe. It might not be pretty, but it’s an important step in understanding your financial situation.

Step 3: Do the Math

Once you’ve tallied up your assets and liabilities, it’s time to crunch the numbers. Simply subtract your total liabilities from your total assets, and voila! You’ve got your net worth. If the number is positive, congrats! You’re in the black. If it’s negative, don’t panic. It just means you have some work to do.

And remember, your net worth isn’t set in stone. It can change over time as you acquire more assets or pay off debts. So, keep track of it regularly and adjust your financial strategy accordingly.

Top 5 Celebrities with Red Hot Net Worth

Let’s talk about some of the biggest names in the game. These celebrities have worked hard (and sometimes smart) to build their red hot net worth. Here’s a look at the top five:

1. Jeff Bezos

As the founder of Amazon, Jeff Bezos is no stranger to wealth. With a net worth of over $100 billion, he’s one of the richest people on the planet. But it wasn’t always smooth sailing. Bezos started Amazon in his garage and grew it into the global powerhouse it is today. His secret? Innovation and perseverance.

2. Elon Musk

Elon Musk is another name that’s synonymous with success. As the CEO of Tesla and SpaceX, he’s revolutionized the automotive and aerospace industries. His net worth has fluctuated over the years, but as of 2023, it’s estimated to be around $150 billion. Musk’s ability to think outside the box has been key to his success.

3. Rihanna

Who knew a pop star could become a billionaire? Rihanna, aka Robyn Fenty, has built an empire that includes music, fashion, and beauty. Her Fenty Beauty line has been a massive success, contributing significantly to her red hot net worth. With an estimated net worth of over $1.7 billion, she’s proving that women can dominate any industry.

4. Beyoncé

Queen Bey needs no introduction. With a career spanning music, film, and fashion, she’s one of the most successful entertainers of all time. Her net worth is estimated to be around $500 million, thanks to her lucrative partnerships and business ventures. Beyoncé’s success is a testament to her talent and hard work.

5. Jay-Z

As Beyoncé’s partner in crime, Jay-Z has also made a name for himself in the business world. From music to sports, he’s diversified his portfolio and built a net worth of over $1 billion. His ability to adapt to changing markets has been crucial to his success.

How to Build Your Own Red Hot Net Worth

So, how can you join the ranks of these financial powerhouses? Here are some tips to help you build your own red hot net worth:

1. Start Investing Early

Time is your greatest ally when it comes to building wealth. The earlier you start investing, the more time your money has to grow. Consider putting your money into stocks, mutual funds, or real estate. Even small investments can add up over time.

2. Diversify Your Portfolio

Don’t put all your eggs in one basket. Spread your investments across different asset classes to reduce risk. This way, if one investment doesn’t perform well, others can help balance it out.

3. Pay Off Debt

Debt can be a major drag on your net worth. Make it a priority to pay off high-interest debts like credit cards and personal loans. The less you owe, the more you can save and invest.

4. Live Below Your Means

It’s easy to get caught up in the latest trends and luxury items, but living below your means is a surefire way to build wealth. Save more, spend less, and focus on long-term goals.

5. Build Multiple Income Streams

Don’t rely on a single source of income. Look for ways to generate additional revenue, whether it’s through side gigs, investments, or starting your own business. The more income streams you have, the more stable your financial future will be.

Common Misconceptions About Net Worth

There are a lot of myths and misconceptions about net worth floating around. Let’s bust some of them:

1. Net Worth Equals Happiness

While having a high net worth can provide financial security, it doesn’t guarantee happiness. Money can buy you comfort, but it can’t buy you joy. Focus on building a balanced life that includes relationships, hobbies, and personal growth.

2. You Need a High Income to Have a High Net Worth

Not necessarily. While a high income can help, it’s not the only factor. Many people with modest incomes have built substantial net worths through smart investing and frugal living. It’s all about making the most of what you have.

3. Debt is Always Bad

Not all debt is created equal. Some types of debt, like mortgages or student loans, can be considered "good" debt because they have the potential to increase your net worth over time. The key is to manage your debt wisely and avoid taking on unnecessary obligations.

Conclusion

So, there you have it, folks! Understanding your red hot net worth is the first step toward financial success. Whether you’re aiming to be the next Jeff Bezos or just trying to pay off your student loans, knowing where you stand financially is crucial. By calculating your net worth, diversifying your investments, and living below your means, you can build a prosperous future for yourself.

Now, it’s your turn to take action. Grab a pen and paper (or your phone) and start calculating your net worth today. And don’t forget to share this article with your friends and family. The more people who understand the importance of net worth, the better off we’ll all be.

Got any questions or comments? Drop them below. I’d love to hear from you!

Table of Contents

- Red Hot Net Worth: The Ultimate Guide to Understanding the Fire of Wealth

- What Exactly Is Net Worth Anyway?

- Why Is Red Hot Net Worth Important?

- How to Calculate Your Net Worth

- Step 1: Tally Up Your Assets

- Step 2: List Your Liabilities

- Step 3: Do the Math

- Top 5 Celebrities with Red Hot Net Worth

- How to Build Your Own Red Hot Net Worth

- Common Misconceptions About Net Worth

- Conclusion

- Thomas Partey Sexual Assault The Truth Behind The Allegations

- Love Story Pictures Of Taylor Swift A Journey Through Her Heartstrings

.png)